Strengthening Our Communities Through Meaningful Partnerships

As a responsible investor and market leader in Bahrain’s financial sector, SICO constantly works to align its strategy with environmental, social, and governance (ESG) principles. As the momentum toward sustainable investments builds worldwide, we are committed to becoming a more sustainable organization in every sense of the word. Accordingly, we work every day to incorporate sound sustainable practices into our day-to-day operations. We are and have always been an equal opportunity employer with a diverse workforce and a culture that promotes the empowerment of women, and we increasingly account for ESG considerations across our investments and business decisions.

SICO takes pride in being an ethical organization that believes “how profits are made” is just as important as “how much profits are made”. We seek to ensure that we are creating value not just for our shareholders, but for all our stakeholders, including our clients, partners, employees, and the community at large. We have worked to align our core values and principles with the United Nations Sustainable Development Goals (SDGs). Our initiatives have been particularly focused on the following SDGs.

Supporting Education

SICO has always been a firm believer that quality education for all is a key driver of economic growth and prosperity. Since its inception, the Bank has sponsored multiple ongoing education and career development initiatives in cooperation with the Bahrain Bourse, the CFA Society, the Bahrain Institute of Banking and Finance (BIBF).

Each year, a large number of young Bahrainis graduate from local and international institutions and enter the job market. For many the competitive landscape can be daunting, which is why SICO also strives to help new graduates enhance their career prospects through a number of initiatives that focus on building leadership skills and improving financial literacy.

Since 2016, SICO has been a sponsor of a specialized trading simulation course given by the BIBF titled “Bank Management Simulation”. In 2021, SICO strengthened the relationship even further with the signing of a new agreement with BIBF to deliver a “Digital Ambassadors” program to provide Bahraini youth with the digital knowledge and skills they need to tackle the professional challenges of digital transformation. The three-week training program for students in their final year of university introduces them to practical digital tools, skills, and concepts that they will need to enter the workforce.

SICO has a long-term partnership with CFA Society Bahrain and has sponsored and participated in multiple events, initiatives, and programs over the years, such as the Society’s Career Day in 2019 and skills building workshops. In 2021 SICO employees participated in the CFA Society’s Qodwa Mentorship Program, which pairs candidates with experienced charter holders as mentors.

The Bank regularly sponsors some of Bahrain’s flagship educational programs, including the Al Mabarrah Al Khalifia Foundation and the Crown Prince’s International Scholarship Program (CPISP). The CPISP is a program established by Bahrain’s Prime Minister and Crown Prince, HRH Prince Salman bin Hamad Al Khalifa, operated through funding by the Crown Prince and a number of local and international sponsors, and it seeks to support talented individuals in their academic journey. SICO began its cooperation with CPISP in 2006 and has since provided support for 140 scholars pursuing higher education degrees at some of the world’s leading educational institutions.

SICO’s internships, executive training programs and mentorship initiatives give young university graduates and students the opportunity to experience careers in finance and to learn from top experts in the field. In 2021 SICO was a mentor in two “Bloomberg Vision” events, as part of Bloomberg’s GCC gender diversity initiative, “A Fair Share.” SICO was able to mentor 25 female students in KSA and to participate in networking sessions that matched female fellows with finance professionals.

SICO sponsored the Ibn Khuldoon National School’s 8th annual Model United Nations (MUN) Conference in 2021, a simulation that allows participants to significantly improve their leadership, public speaking, teamwork, and negotiation skills, while also expanding their vision on contemporary global issues.

SICO continued to sponsor the BHB’s TradeQuest Program, a competitive financial simulation that aims to provide university and high school students with real-life experiences simulating local and international financial markets. In 2021 participants form investment teams consisting of 7–8 members were given virtual portfolios worth BD 500,000 and USD 4 million to invest in companies listed on the BHB and New York Stock Exchange (NYSE). SICO has been a supporter of the program since its inception.

Improving Healthcare and Social Services

Healthcare

Improving the wellbeing and overall health of our community has been one of the main pillars of SICO’s CSR agenda for many years. SICO and its staff members contribute to and participate in a variety of initiatives focused on improving healthcare and social services within the country. In the past, our collective and individual efforts have included hosting an event for children suffering from cancer and sickle cell anemia in collaboration with Dream Society Bahrain; sponsoring the Rotary Club of Manama’s Bahrain Annual Six-a-Side Football Tournament to raise money for the Bahrain Cancer Society; and organizing a team to participate in the Bahrain Marathon Relay, an annual event that raises funds for many charities in Bahrain.

Over the years SICO has been the proud supporter of healthcare initiatives such as blood drives, the Movember Foundation, the breast cancer awareness movement “Think Pink,” and the Alia for Early Intervention Center for children with behavioral and communication disabilities.

SICO also regularly extends support to the following causes and charities:

• Bahrain Breast Cancer Awareness

• Bahrain Down Syndrome Society

• Al Noor Charity Welfare

• UCO Parents Care Center

• Children and Mothers Welfare Society

• Child Care Home

• Alia Early Intervention

Following the onset of the COVID-19 pandemic in 2020, SICO has made a number of donations to charitable organizations across the kingdom in order to alleviate the worst of this impact. Among the initiatives supported are the Fina Khair campaign, an initiative launched by the Royal Humanitarian Foundation in response to a growing desire among the private sector to contribute to combatting the spread of the virus.

Sports

Since 2018 SICO as undertaken sponsorships that promote the wellbeing of youth and revitalize sports and youth athletics across Bahrain. Accordingly, SICO was the proud sponsor of the 2018/2019 and the 2019/2020 Kings Football Cup and the Prince Nasser Bin Hamad Premier League Football Tournament.

SICO also sponsored a local wellbeing initiative, the TeamBahrain30for30 challenge, which encouraged people to exercise for 30 minutes each day, with total donations going to support the Fina Khair campaign.

Social Services

In 2021, SICO supported the efforts of the Founder and Chairperson of the Board of the Shaikh Ebrahim bin Mohammed Center for Culture and Research (Shaikh Ebrahim Center), H.E. Shaikha Mai Bint Mohammed Al-Khalifa. The Shaikh Ebrahim Center was established in 2002 as a forum for dialogue on philosophy, literature, poetry, culture, and the arts.

SICO allocated resources to support the efforts of Bahrain-based non-profit Shamsaha, the Middle East’s only crisis response center for women in search of empowerment, independence, and safety. The funding was targeted toward empowering women who have experienced domestic abuse by covering various expenses for their rehabilitation.

An MOU was signed in 2021 with Warsha Consultancy and Development, a Bahrain-based social enterprise, to establish a framework for collaboration on the “Support and Accelerate Women’s Inclusion” (SAWI) project. SAWI aims to develop and implement inclusive policies and practices for improved recruitment, retention, and promotion of women.

SICO also supported a nationwide public awareness campaign in 2021 on fraud spearheaded by the Bahrain Association of Banks (BAB) to create awareness of electronic fraud operations targeting financial services.

Preserving the Environment

SICO is committed not only to ensuring that its operations have no adverse impact on the environment but also to raising awareness and promoting sustainable business practices across its surrounding community to preserve the environment. SICO’s internal Go Green initiative has raised awareness within the Bank on practices that both the Bank and our employees can adopt to reduce our carbon footprint.

SICO has adopted a number of measures to minimize its environmental impact such as providing employees with personalized reusable glass water bottles to reduce the use of single-use plastics. We have also changed default settings on all printers across the Bank to black and white and double-sided printing in order to reduce our paper and ink consumption, thereby reducing both paper and electronic waste. Efforts to increase digitalization across the Bank, including automating and digitalizing a range of services has also resulted in a considerable decrease in paper usage across the Bank.

We also encourage employees to turn off monitors, lights, and other electronic equipment at the end of the day and have instructed them to close applications on their computers when not in use to reduce energy consumption.

In 2020, SICO successfully managed its energy consumption, reducing electricity and water consumption by 11%, in spite of a 7% increase in the area of the Bank’s premises. This continues to build on the achievements SICO made in 2019, successfully reducing its consumption by 29% from the preceding year. In addition, the Bank was able to successfully reduce its paper consumption by 55% in 2020.

To further measure and monitor its impact on the environment as a business, SICO published its first GHG (greenhouse gas) Emissions Report in 2021, presenting a detailed report that quantifies how much carbon is released as a result of our daily activities and operations. The report includes a thorough breakdown of SICO’s GHG emissions from 1 January to 31 December 2021, and it concludes that the total GHG emissions of our business as of 2021 were 571.962 Mt CO2e. Our emissions per employee also came in well below Bahrain’s GHG intensity rate per capita and in line with the GCC’s average per employee for the financial sector in the GCC.

SICO has also completed a carbon offsetting exercise and is now carbon neutral.

Please check our latest GHG Report for more details.

Environmental Initiatives

In 2021, SICO was active with a number of key initiatives, including our support for Bahrain’s national afforestation campaign “Forever Green”. SICO was the first Bank in Bahrain to launch this type of initiative and, as such, management was keen to build on the success of their first project in 2020 to plant trees on 16th December Avenue in collaboration with the National Initiative for Agricultural Development (NIADBH) and the Northern Municipality.

SICO also launched an electronic e-waste initiative in 2021 in partnership with Crown Industries, a recycling operation in Bahrain. The initiative involved the collection and recycling of discarded electronics, such as mobile phones, computers, and televisions and other personal electronic equipment. Such an initiative not only saves space and reduces storage costs, but also offsets the negative impact of e-waste on the environment.

SICO has also made agreements with an external vendor to recycle all its paper and plastic waste in an effort to encourage employees to be more mindful of their waste inside and outside of the office and to help them adopt a greener mindset and more environmentally-friendly habits.

As part of its commitment to running sustainable operations and contributing to preserving the environment, SICO will continue with both internal green initiatives and the planting of trees in 2022.

Advancing the Financial Sector

Financial institutions worldwide are keen to integrate innovative technology solutions into their day-to-day operations in order to revolutionize the way that they interact with clients, offering them leading solutions and promoting digitalization across the industry. Bahrain is currently fast emerging as a regional leader in the fintech space with a number of growing local players. SICO is proud to have partnered with Fintech Bay, a versatile technology incubator that offers entrepreneurs a dedicated co-working space featuring state-of-the-art meeting rooms, innovation labs, acceleration programs, and educational opportunities.

SICO is also a key sponsor of Bahrain’s CFA society, a non-profit organization established by the CFA Institute in 2006. The society contributes to the development of local capital markets and the professional skills of its members through educational initiatives, volunteer opportunities, and networking events.

SICO’s CEO, Najla Al-Shirawi, along with senior executives from all of SICO’s business lines are regular participants in conferences and panels addressing key issues in the financial sector in Bahrain and throughout the GCC.

Client Relationships

The team of dedicated and experienced professionals that make up SICO’s Client Relations department work to oversee requests, respond to inquiries, and provide guidance to both existing and potential clients. The department also prioritizes customer experience by making gradual and measurable changes. The main purpose of the department is to build sustainable, long-term, and professional relationships with the Bank’s customers. Client Relations has a wide and varied scope of activities, including managing and advocating for clients’ needs with the Bank’s different business lines; the on-boarding of new accounts as well as completing and updating all client KYC details to ensure full compliance with CBB regulations. Going forward, SICO’s Client Relations department will continue to automate and to empower clients to execute transactions digitally.

Privacy

SICO is committed to maintaining the confidentiality, integrity and security of information collected from customers, in accordance with all applicable privacy laws. For the purposes of privacy laws in Bahrain, SICO acts as the ‘Data Manager’ in respect to any personal information received from clients.

The manner in which information is collected, shared and processed through all means including corporate offices, subsidiaries, affiliates, the SICO website, as well as any other direct or indirect interactions with the Bank is defined by SICO’s privacy policy.

Please click here for our full Privacy Policy

Digitalization

SICO’s IT department continues to make major strides in Cloud computation with the successful transfer of SICO’s internal systems and projects to the Cloud. The department has successfully streamlined the bank’s operations, providing clients with a more seamless suite of services.

SICO has also integrated Bloomberg AIM into its digitization efforts in order to automate all Asset Management operations. SICO is also utilizing Bloomberg’s AIM solution to implement a system that will help SFS automate most of its operational processes and facilitate the plan to launch online services for SFS clients before the end of Q3 2022.

Digital Customer Onboarding for SICO’s online trading platform, SICO LIVE is now complete, enabling customers to seamlessly register on SICO LIVE without the necessity for in-person visits or interactions. Plans are also in the works to enhance automatic customer onboarding by introducing electronic identification and verification, in addition to integration with the national e-KYC that will allow Bahraini nationals and residents to retrieve their KYC information seamlessly from the government database.

A new IT system for SICO’s subsidiary, SFS is now in place. The new integrated CORE structure for custody, fund administration, and registrar services will completely automate customer service processes.

Cybersecurity

The enhancement of all of SICO’s cyber security is a pillar of the IT department, and many advancements have been made in 2021 to cybersecurity controls to ensure the safety and protection of all systems. This includes the revision of SICO’s framework in alignment with market standards, the expansion of scope in terms of information security officers, and the upgrade of anti-money laundering controls. The department is currently in talks with reputable parties for a cybersecurity operations center (SOC) and there will be a dedicated professional and highly experienced team in place by early 2022 for monitoring SICO’s IT infrastructure and systems around the clock using the latest machine learning technologies.

Equal Opportunity in the Workplace

SICO believes that its most valuable asset is its people. One of the Bank’s biggest competitive advantages over the past 26 years has been its hardworking and loyal team of talented investment professionals who are viewed as partners and active participants in the Bank’s evolving growth story. SICO strives to create a corporate culture that values diversity, teamwork and open communication.

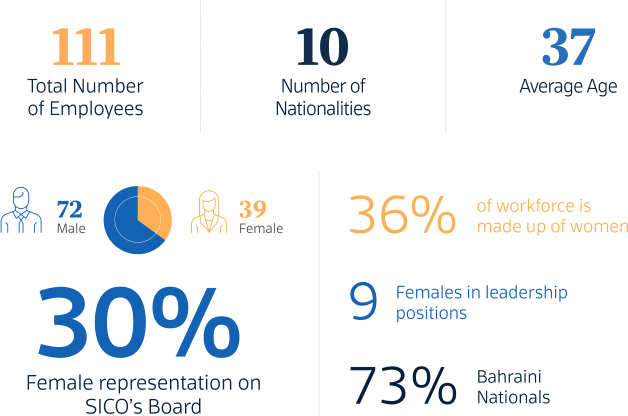

SICO prides itself on the diversity of its team, which is comprised of different nationalities, with 73% of employees being Bahraini nationals, among whom 36% are women.

Female empowerment and gender equality in the workplace are an integral component of SICO’s core values. Since 2014, the Bank has been under the leadership of Najla Al-Shirawi, the Bank’s first female CEO. In 2017, we established an Equal Opportunity Committee under the auspices of SICO’s Charter for Gender Diversity. The committee is tasked with ensuring equal employment opportunities for men and women at SICO as well as identifying areas in which our policies, procedures, and practices can be improved to promote gender inclusion and diversity.

SICO’s Board of Directors includes three female Board Members, amounting to more than a 30% representation, and 36% of SICO’s total workforce is made up of women, with nine women currently in leadership positions. Additionally, four of subsidiary SFS’s six board members are women. The Bank’s Gender Balance Committee is tasked with identifying gaps in the workplace, issuing recommendations and actions plans, and implementing policies and procedures that aim to cement the principles of gender balance in the workplace.

SICO has also emphasized the representation of Bahraini women among its workforce. Out of 74 Bahrani employees at SICO and SFS, 38 are women (>51% of our total Bahrani workforce). Additionally, Bahrani women occupy seven Grade 3 and higher positions, while eight Bahrani men occupy Grade 3 and higher positions.

| Male |

Female |

Total |

|

| SICO BSC | 55 | 36 | 91 |

| SICO FUNDS SERVICES | 7 | 3 | 10 |

| SICO FINANCIAL BROKERAGE (UAE) | 9 | 2 | 11 |

| SICO CAPITAL | 21 | 11 | 32 |

We believe that fostering a welcoming professional environment, promoting healthy competition, and rewarding exceptional achievement are key to maintaining employee satisfaction and retention.

The Bank is committed to cultivating the talent of our employees through mentorships at all levels within the organization, proper succession planning and promoting from within, as this helps us strengthen institutional memory and ensure the stability of our operations. SICO continues to provide career development opportunities by offering funding for employees to further their education and professional qualifications such as CFA. SICO currently employs 15 CFA holders. The Bank also regularly hosts training sessions in order to further build the capacity of its employees and support them in their career progression.

2021 Trainings:

.png )

SICO strives to be considered an employer of choice in Bahrain and actively works to offer employees an array of benefits that surpass the minimum requirements under Bahraini labor law.

In 2021, SICO continued to prioritize the health and safety of its people during year two of the COVID-19 pandemic. The Bank conducted a health checkup for all employees aged 35 and above for women and aged 40 and above for men. SICO is committed to promoting a flexible work environment for the wellbeing of all its employees.

In an effort to provide the best support for staff and ensure optimal work-life balance, SICO is offering Work from Home (WFH) options. SICO’s WFH Policy aims to improve employee wellbeing, increase job satisfaction, improve productivity, and ensure that SICO continues to retain employees and attract talented new applicants. SICO employees are also given 30 annual leave days (excluding the sick leave balance) in order to further promote a healthy work-life balance.

The Bank also offers an array of additional support services in order to integrate family needs into the work environment. Among these services are:

- 1. Children study allowance (offered to Grade 3 employees and above)

- 2. Life insurance

- 3. Medical insurance covering immediate family members

- 4. Flexible working hours

- 5. Health club allowance (offered to Grade 4 employees and above)

- 6. Paternity leave

- 7. Enhanced building accessibility for people with disabilities

- 8. Inclusion of women and family needs in building design (such as including lactation rooms in offices)

- 9. WFH policy (effective since March 2022)

As part of SICO’s ongoing desire to improve employee benefits, we are introducing a new employee savings scheme (ESS), which is expected to officially launch in Q3 2022.

In 2021, SICO also rolled out its first annual Employee Engagement Survey with LAWES, a globally renowned survey designed to measure engagement. The survey allowed SICO to take an in-depth look at criteria specific to the organization and to identify strengths and weaknesses. SICO’s overall engagement index score stood at 4.33 on a five-point scale, which places the Bank well above the 75th percentile. The excellent score revealed that SICO’s staff is highly engaged, which generally translates into higher levels of growth, profitability, and innovation across the organization.

In addition to its internal policies to support gender equality, SICO also sponsored a social impact program overseen by AIESEC in Bahrain, “Impact Bahrain: Women Empowerment”, in collaboration with local organizations, Afkarech and Awal. The program was operational from December 2019 until February 2020.

Governance

SICO is committed to upholding the highest standards of corporate governance. This entails complying with regulatory requirements, protecting the rights and interests of all stakeholders, enhancing shareholder value, and achieving organizational efficiency. The Bank has Board-approved policies for risk management, compliance and internal controls, in accordance with the rules and guidelines from the Central Bank of Bahrain (CBB). SICO’s Board of Directors consists of nine Directors, three of whom are Independent directors, and six are Executive directors, including the Chairman and Vice-Chairman.

SICO has adopted a whistle blowing policy and operates under the supervision of the CBB in compliance with Decree Law No. (4) of 2001 and its amendments (collectively, “the AML Law”) with respect to the Prevention and Prohibition of money laundering. The CBB has adopted and is compliant with the recommendations issued by the Financial Action Task Force (“FATF”), which are the international standard for effective anti-money laundering regimes and the requirements of the Basel committee (Customer Due Diligence for Bank’s paper, that are relevant to conventional bank licensees. The Kingdom of Bahrain is a member of the Gulf Cooperation Council (GCC), which is a member of FATF, and also a member of MENAFATF, which is an associate member of FATF.